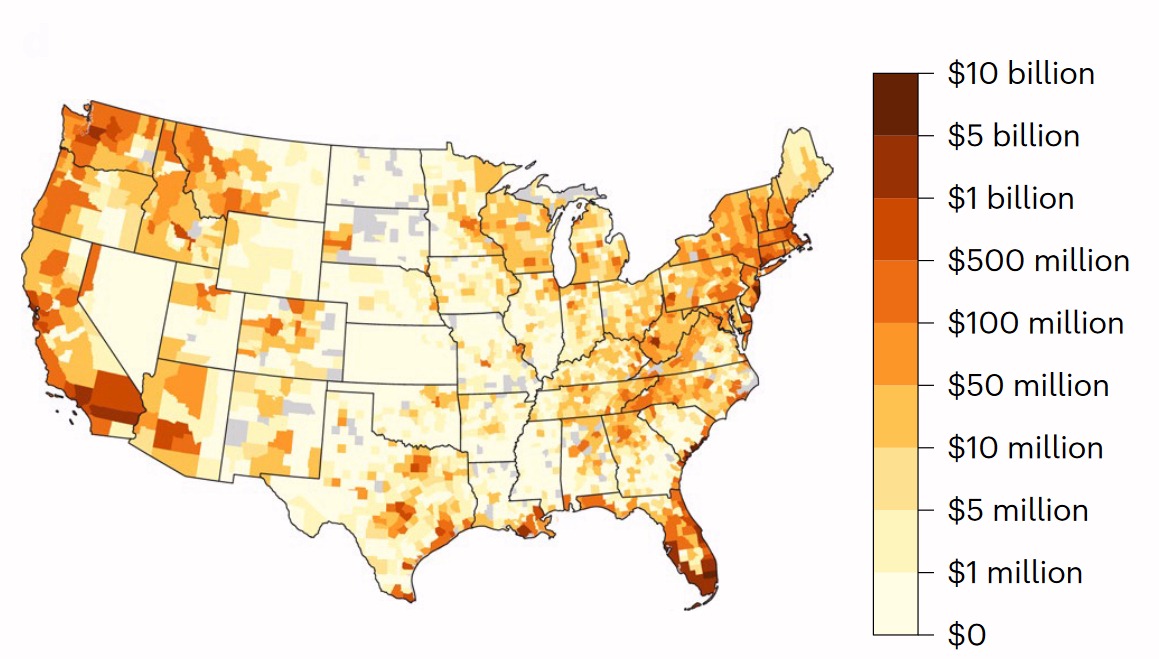

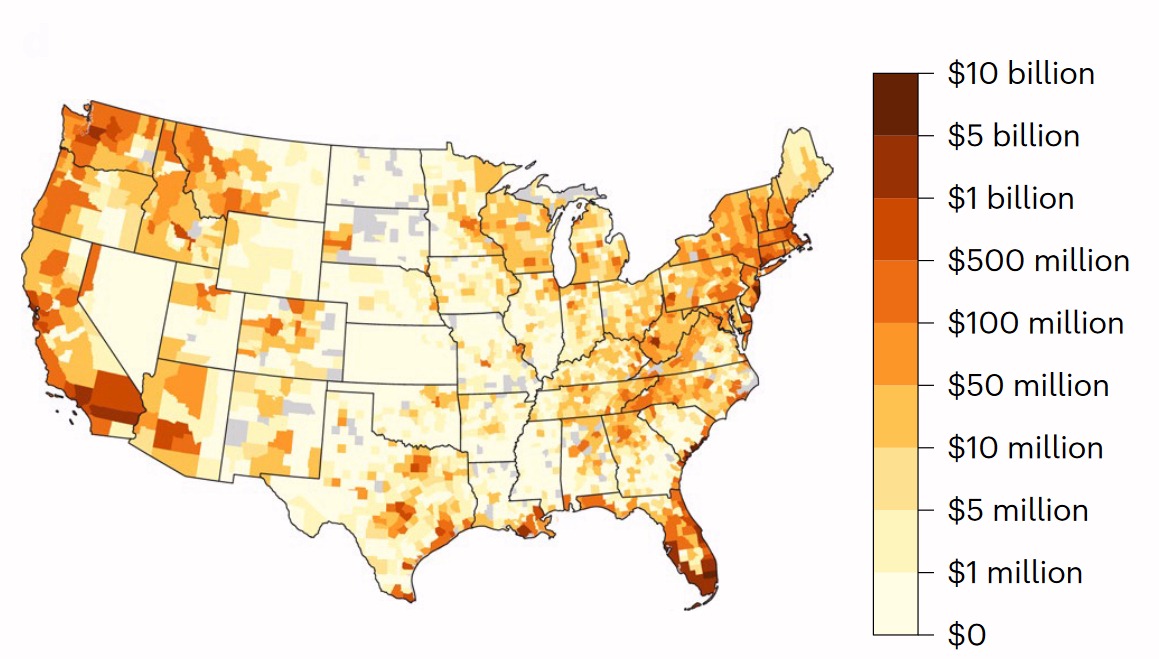

High Flood Risk Real Estate (The darker the color the higher the risk)

Climate change poses many risks to real estate values. In general, as energy is added to a system, the fluctuations in the system increase. So, we expect more storms, more droughts, more wildfires, more floods, more fluctuations of all kinds. What we are saying is that weather conditions will become more volatile due to the impact of humans. For the most part, weather events will become more extreme. Even the momentum of rain will cause a harder rain to fall damaging roofs, sidewalks, and driveways.

Some of the most vulnerable real estate is along coastlines and near floodplains. The study published in the Journal Nature Unpriced climate risk and the potential consequences of overvaluation in US housing markets found:

Climate change impacts threaten the stability of the US housing market. In response to growing concerns that increasing costs of flooding are not fully captured in property values, we quantify the magnitude of unpriced flood risk in the housing market by comparing the empirical and economically efficient prices for properties at risk. We find that residential properties exposed to flood risk are overvalued by US$121--US$237 billion, depending on the discount rate. In general, highly overvalued properties are concentrated in counties along the coast with no flood risk disclosure laws and where there is less concern about climate change. Low-income households are at greater risk of losing home equity from price deflation, and municipalities that are heavily reliant on property taxes for revenue are vulnerable to budgetary shortfalls.

Sidd Mukherjee said, "Pay close attention to Figure 4 in the main paper (top left map, zoom in to max.) The red boundaries are where properties are seriously overvalued and where tax revenues will collapse after flooding."

Sidd goes on to say, "Don't miss the supplementaries."

Flood Risk to Real Estate Supplementaries